How Much Is Property Tax In Westchester Ny . in dollar terms, westchester county has some of the highest property taxes not only in the state of new york, but in the entire country. below are property tax rates since 2002. westchester county ( 1.62%) has a 1.2% lower property tax rate than the average of new york ( 1.64% ). 2024 special district tax rates. we offer you access to historical property tax rates, equalization rates, residential assessment ratios, county property tax. to use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase. the median property tax (also known as real estate tax) in westchester county is $9,003.00 per year, based on a median. how the property tax works.

from dxozainez.blob.core.windows.net

the median property tax (also known as real estate tax) in westchester county is $9,003.00 per year, based on a median. to use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase. how the property tax works. in dollar terms, westchester county has some of the highest property taxes not only in the state of new york, but in the entire country. below are property tax rates since 2002. westchester county ( 1.62%) has a 1.2% lower property tax rate than the average of new york ( 1.64% ). we offer you access to historical property tax rates, equalization rates, residential assessment ratios, county property tax. 2024 special district tax rates.

Property Tax Westchester County New York at Glenn McNair blog

How Much Is Property Tax In Westchester Ny 2024 special district tax rates. westchester county ( 1.62%) has a 1.2% lower property tax rate than the average of new york ( 1.64% ). we offer you access to historical property tax rates, equalization rates, residential assessment ratios, county property tax. how the property tax works. to use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase. the median property tax (also known as real estate tax) in westchester county is $9,003.00 per year, based on a median. below are property tax rates since 2002. 2024 special district tax rates. in dollar terms, westchester county has some of the highest property taxes not only in the state of new york, but in the entire country.

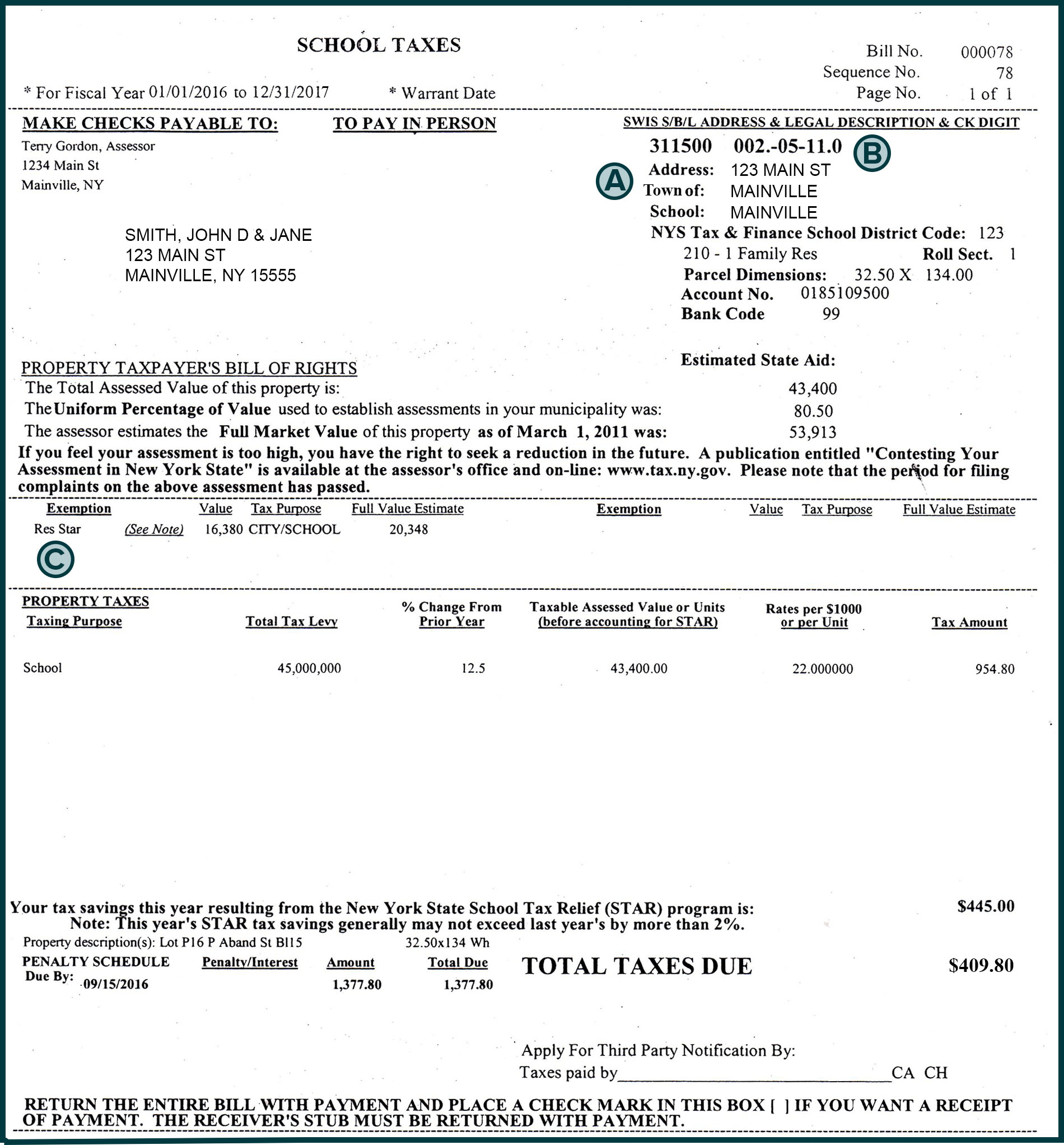

From www.tax.ny.gov

Property tax bill examples How Much Is Property Tax In Westchester Ny we offer you access to historical property tax rates, equalization rates, residential assessment ratios, county property tax. in dollar terms, westchester county has some of the highest property taxes not only in the state of new york, but in the entire country. how the property tax works. the median property tax (also known as real estate. How Much Is Property Tax In Westchester Ny.

From www.taxmypropertyfairly.com

Upstate NY Has Some of the Highest Property Tax Rates in the Nation How Much Is Property Tax In Westchester Ny how the property tax works. westchester county ( 1.62%) has a 1.2% lower property tax rate than the average of new york ( 1.64% ). 2024 special district tax rates. the median property tax (also known as real estate tax) in westchester county is $9,003.00 per year, based on a median. we offer you access to. How Much Is Property Tax In Westchester Ny.

From taxfoundation.org

How High Are Property Tax Collections Where You Live? Tax Foundation How Much Is Property Tax In Westchester Ny westchester county ( 1.62%) has a 1.2% lower property tax rate than the average of new york ( 1.64% ). 2024 special district tax rates. the median property tax (also known as real estate tax) in westchester county is $9,003.00 per year, based on a median. to use the calculator, just enter your property's current market value. How Much Is Property Tax In Westchester Ny.

From www.hauseit.com

How Much Are Real Estate Transfer Taxes in Westchester County? How Much Is Property Tax In Westchester Ny in dollar terms, westchester county has some of the highest property taxes not only in the state of new york, but in the entire country. how the property tax works. to use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase. we offer you access to historical. How Much Is Property Tax In Westchester Ny.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills How Much Is Property Tax In Westchester Ny in dollar terms, westchester county has some of the highest property taxes not only in the state of new york, but in the entire country. the median property tax (also known as real estate tax) in westchester county is $9,003.00 per year, based on a median. how the property tax works. westchester county ( 1.62%) has. How Much Is Property Tax In Westchester Ny.

From www.hauseit.com

The Complete Guide to Closing Costs in NYC Hauseit® How Much Is Property Tax In Westchester Ny how the property tax works. westchester county ( 1.62%) has a 1.2% lower property tax rate than the average of new york ( 1.64% ). we offer you access to historical property tax rates, equalization rates, residential assessment ratios, county property tax. 2024 special district tax rates. to use the calculator, just enter your property's current. How Much Is Property Tax In Westchester Ny.

From www.pinterest.com

Ranking of best places to buy a house in Westchester County based on How Much Is Property Tax In Westchester Ny we offer you access to historical property tax rates, equalization rates, residential assessment ratios, county property tax. 2024 special district tax rates. the median property tax (also known as real estate tax) in westchester county is $9,003.00 per year, based on a median. below are property tax rates since 2002. to use the calculator, just enter. How Much Is Property Tax In Westchester Ny.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet How Much Is Property Tax In Westchester Ny 2024 special district tax rates. in dollar terms, westchester county has some of the highest property taxes not only in the state of new york, but in the entire country. westchester county ( 1.62%) has a 1.2% lower property tax rate than the average of new york ( 1.64% ). to use the calculator, just enter your. How Much Is Property Tax In Westchester Ny.

From giswww.westchestergov.com

Westchester County Municipal Tax Parcel Viewer How Much Is Property Tax In Westchester Ny the median property tax (also known as real estate tax) in westchester county is $9,003.00 per year, based on a median. below are property tax rates since 2002. how the property tax works. westchester county ( 1.62%) has a 1.2% lower property tax rate than the average of new york ( 1.64% ). 2024 special district. How Much Is Property Tax In Westchester Ny.

From www.youtube.com

How Much are Real Estate Transfer Taxes in Westchester County, NY How Much Is Property Tax In Westchester Ny westchester county ( 1.62%) has a 1.2% lower property tax rate than the average of new york ( 1.64% ). to use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase. 2024 special district tax rates. the median property tax (also known as real estate tax) in westchester. How Much Is Property Tax In Westchester Ny.

From paheld.com

New York City Property Taxes (2023) How Much Is Property Tax In Westchester Ny we offer you access to historical property tax rates, equalization rates, residential assessment ratios, county property tax. below are property tax rates since 2002. to use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase. in dollar terms, westchester county has some of the highest property taxes. How Much Is Property Tax In Westchester Ny.

From www.taxmypropertyfairly.com

Upstate NY Has Some of the Highest Property Tax Rates in the Nation How Much Is Property Tax In Westchester Ny westchester county ( 1.62%) has a 1.2% lower property tax rate than the average of new york ( 1.64% ). 2024 special district tax rates. in dollar terms, westchester county has some of the highest property taxes not only in the state of new york, but in the entire country. we offer you access to historical property. How Much Is Property Tax In Westchester Ny.

From www.youtube.com

How To Buy A Home Westchester Taxes Or Bronx Taxes YouTube How Much Is Property Tax In Westchester Ny westchester county ( 1.62%) has a 1.2% lower property tax rate than the average of new york ( 1.64% ). to use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase. we offer you access to historical property tax rates, equalization rates, residential assessment ratios, county property tax.. How Much Is Property Tax In Westchester Ny.

From www.pinterest.com

How much do you pay in property taxes compared to previous years? https How Much Is Property Tax In Westchester Ny the median property tax (also known as real estate tax) in westchester county is $9,003.00 per year, based on a median. below are property tax rates since 2002. westchester county ( 1.62%) has a 1.2% lower property tax rate than the average of new york ( 1.64% ). how the property tax works. 2024 special district. How Much Is Property Tax In Westchester Ny.

From dxozainez.blob.core.windows.net

Property Tax Westchester County New York at Glenn McNair blog How Much Is Property Tax In Westchester Ny in dollar terms, westchester county has some of the highest property taxes not only in the state of new york, but in the entire country. we offer you access to historical property tax rates, equalization rates, residential assessment ratios, county property tax. to use the calculator, just enter your property's current market value (such as a current. How Much Is Property Tax In Westchester Ny.

From www.cashbuyersny.com

Latest Property Taxes in New York State Cash Buyers NY How Much Is Property Tax In Westchester Ny below are property tax rates since 2002. how the property tax works. in dollar terms, westchester county has some of the highest property taxes not only in the state of new york, but in the entire country. the median property tax (also known as real estate tax) in westchester county is $9,003.00 per year, based on. How Much Is Property Tax In Westchester Ny.

From www.mansionglobal.com

How Much Could Property Taxes Rise in Westchester, New York, If the Cap How Much Is Property Tax In Westchester Ny below are property tax rates since 2002. how the property tax works. we offer you access to historical property tax rates, equalization rates, residential assessment ratios, county property tax. in dollar terms, westchester county has some of the highest property taxes not only in the state of new york, but in the entire country. westchester. How Much Is Property Tax In Westchester Ny.

From www.hauseit.com

NYC Property Tax Bills How to Download and Read Your Bill How Much Is Property Tax In Westchester Ny to use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase. below are property tax rates since 2002. how the property tax works. in dollar terms, westchester county has some of the highest property taxes not only in the state of new york, but in the entire. How Much Is Property Tax In Westchester Ny.